The 7-Minute Rule for Best Broker For Forex Trading

The 7-Minute Rule for Best Broker For Forex Trading

Blog Article

8 Easy Facts About Best Broker For Forex Trading Shown

Table of ContentsBest Broker For Forex Trading for DummiesSome Of Best Broker For Forex Trading8 Easy Facts About Best Broker For Forex Trading DescribedThe Greatest Guide To Best Broker For Forex TradingHow Best Broker For Forex Trading can Save You Time, Stress, and Money.

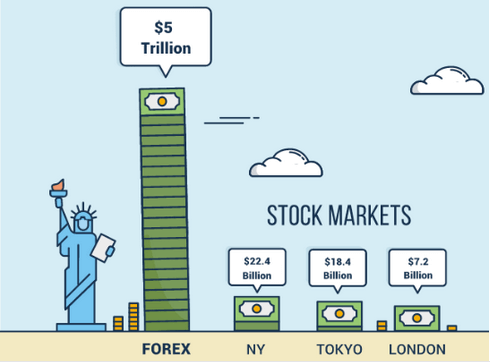

Considering that Foreign exchange markets have such a big spread and are made use of by a huge number of participants, they supply high liquidity on the other hand with various other markets. The Forex trading market is frequently running, and many thanks to contemporary innovation, comes from anywhere. Hence, liquidity refers to the truth that any individual can buy or offer with a straightforward click of a button.As a result, there is constantly a prospective retailer waiting to get or offer making Forex a liquid market. Rate volatility is one of one of the most vital elements that assist choose the following trading action. For short-term Foreign exchange investors, cost volatility is important, because it portrays the per hour adjustments in a possession's worth.

For long-lasting investors when they trade Forex, the cost volatility of the marketplace is additionally basic. This is why they take into consideration a "buy and hold" technique might use greater incomes after an extended period. An additional considerable advantage of Forex is hedging that can be related to your trading account. This is an efficient method that aids either get rid of or decrease their danger of losses.

Facts About Best Broker For Forex Trading Uncovered

Relying on the moment and initiative, investors can be split right into groups according to their trading design. A few of them are the following: Foreign exchange trading can be successfully applied in any one of the methods above. Due to the Forex market's great volume and its high liquidity, it's possible to get in or leave the market any time.

Forex trading is a decentralized innovation that functions without any main administration. That's why it is much more at risk to scams and other types of risky tasks such as deceptive guarantees, too much high threat degrees, etc. Thus, Forex policy was created to establish a straightforward and ethical trading mindset. A foreign Forex broker should comply with the criteria that are defined by the Forex regulator.

Hence, all the transactions can be made from anywhere, and because it is open 24-hour a day, it can likewise be done at any moment of the day. For instance, if a financier lies in Europe, he can trade throughout The United States and copyright hours and monitor the actions of the one money he wants (Best Broker For Forex Trading).

Examine This Report on Best Broker For Forex Trading

Many Foreign exchange brokers can offer a really reduced spread and reduce or also eliminate the investor's expenses. Investors that select the Foreign exchange market can increase their revenue by preventing costs from exchanges, deposits, and various other trading tasks which have extra retail purchase costs in the stock market.

It offers official source the alternative to enter the market with a little spending plan and profession with high-value currencies. Some investors might not satisfy the needs of high take advantage of at the end of the transaction.

Forex trading may have trading terms to protect the market participants, yet there is basics the risk that someone may not respect the concurred agreement. The Foreign exchange market functions 24 hours without stopping.

The larger those ups and downs are, the higher the rate volatility. Those large adjustments can stimulate a sense of unpredictability, and often traders consider them as a chance for high profits.

The 10-Second Trick For Best Broker For Forex Trading

Some of the most unpredictable currency sets are considered to be the following: The Foreign exchange market offers a whole lot of privileges to any kind of Forex investor. When having made a decision to trade on fx, both knowledgeable and newbies need to specify their financial method and get aware of the terms.

The content of this article shows the writer's opinion and does not necessarily reflect the main placement of LiteFinance broker. The material published on this web page is given for informational functions just and should not be thought about as the stipulation of investment guidance for the functions of Instruction 2014/65/EU. According to copyright law, this short article is thought about copyright, which includes a prohibition on duplicating and dispersing it without authorization.

If your company operates internationally, it is very important to comprehend how the worth of the united state buck, family you could look here member to other currencies, can substantially impact the cost of items for U.S. importers and merchants.

Top Guidelines Of Best Broker For Forex Trading

In the very early 19th century, currency exchange was a significant part of the procedures of Alex. Brown & Sons, the first investment financial institution in the USA. The Bretton Woods Contract in 1944 called for currencies to be secured to the US dollar, which remained in turn fixed to the cost of gold.

Report this page